Twilio Platform | Jul. 01, 2019

VAT Invoices Available for Customers in Europe

Starting July 1st, 2019, we have begun collecting Value-Added Tax (VAT) on the services sold to our customers in 32 countries in Europe. Nonresident entities, such as Twilio Inc. are now required by European taxing authorities to collect Value-Added Tax (VAT) on its sales of its services to customers located in the listed countries.

Twilio is only required to impose VAT on Business to Customer (B2C) transactions. Business to Business (B2B) customers are tax exempt, and will be treated as such when a valid VAT number is entered via the Billing Preferences page on console.

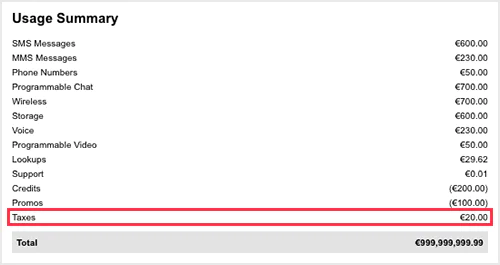

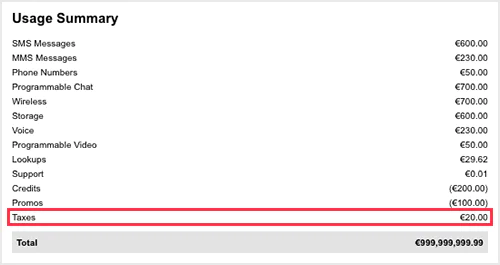

VAT for the previous month is assessed on the first day of the following month. For example, you will be charged VAT for your July usage in August. You can see the VAT amount charged in your invoice.